🪙 Clear and organized paydays

How might we empower SMBs to manage their finances online?

Context

In 2024-2025, I worked as a product design contractor on a B2B scheduling software with CRM and finance management features.

Alongside a PM partner, we were the only design experts embedded in a team of engineers and founders. I owned end-to-end design & flow mapping for 8 sprints.

Goal

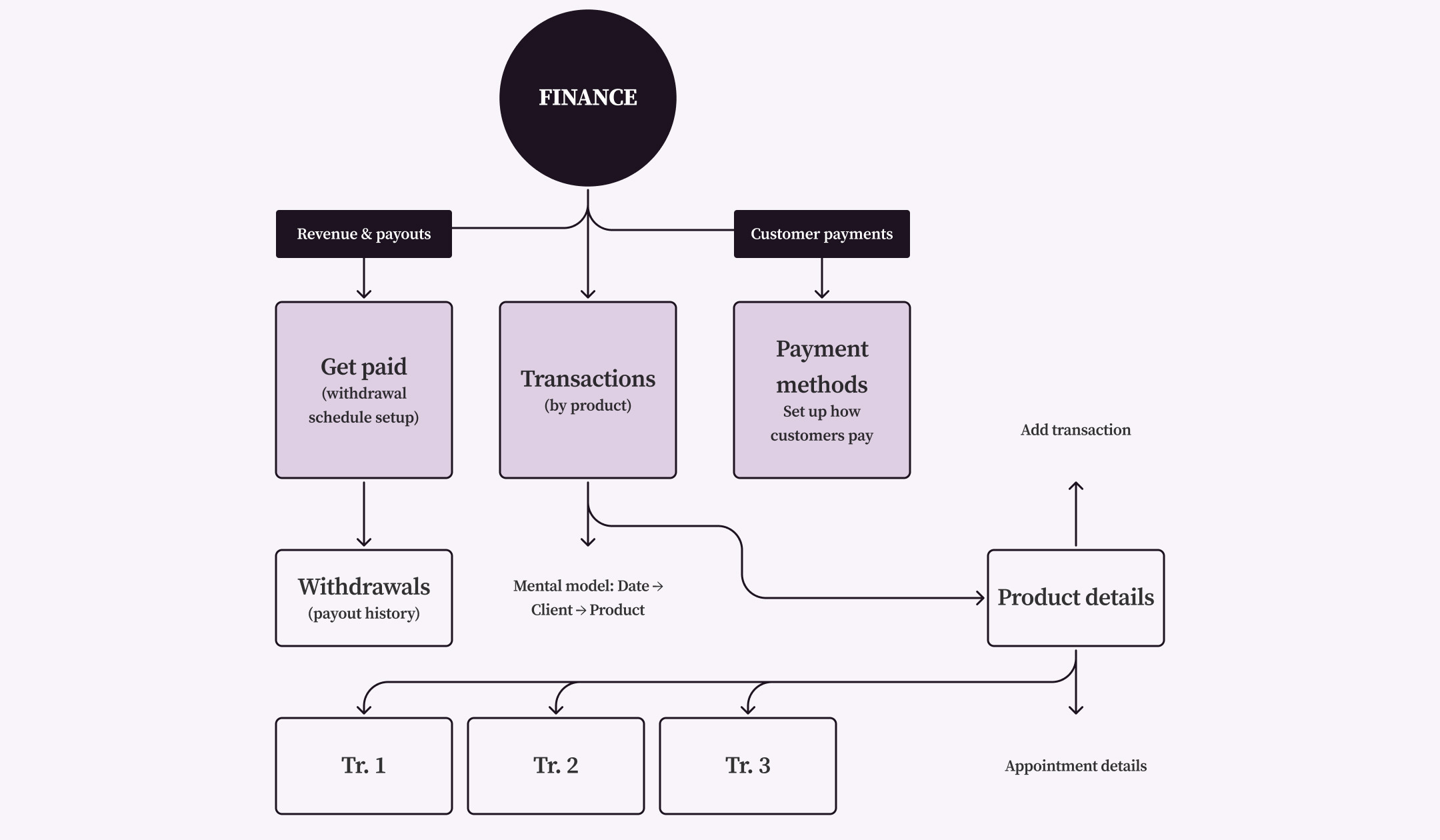

To design the finance tab’s information architecture so that transactions are easy to find, and online payment is intuitive to enable and work with.

💡

Greatest UX challenge

To accommodate financial complexity that scales with the number of services and transactions.

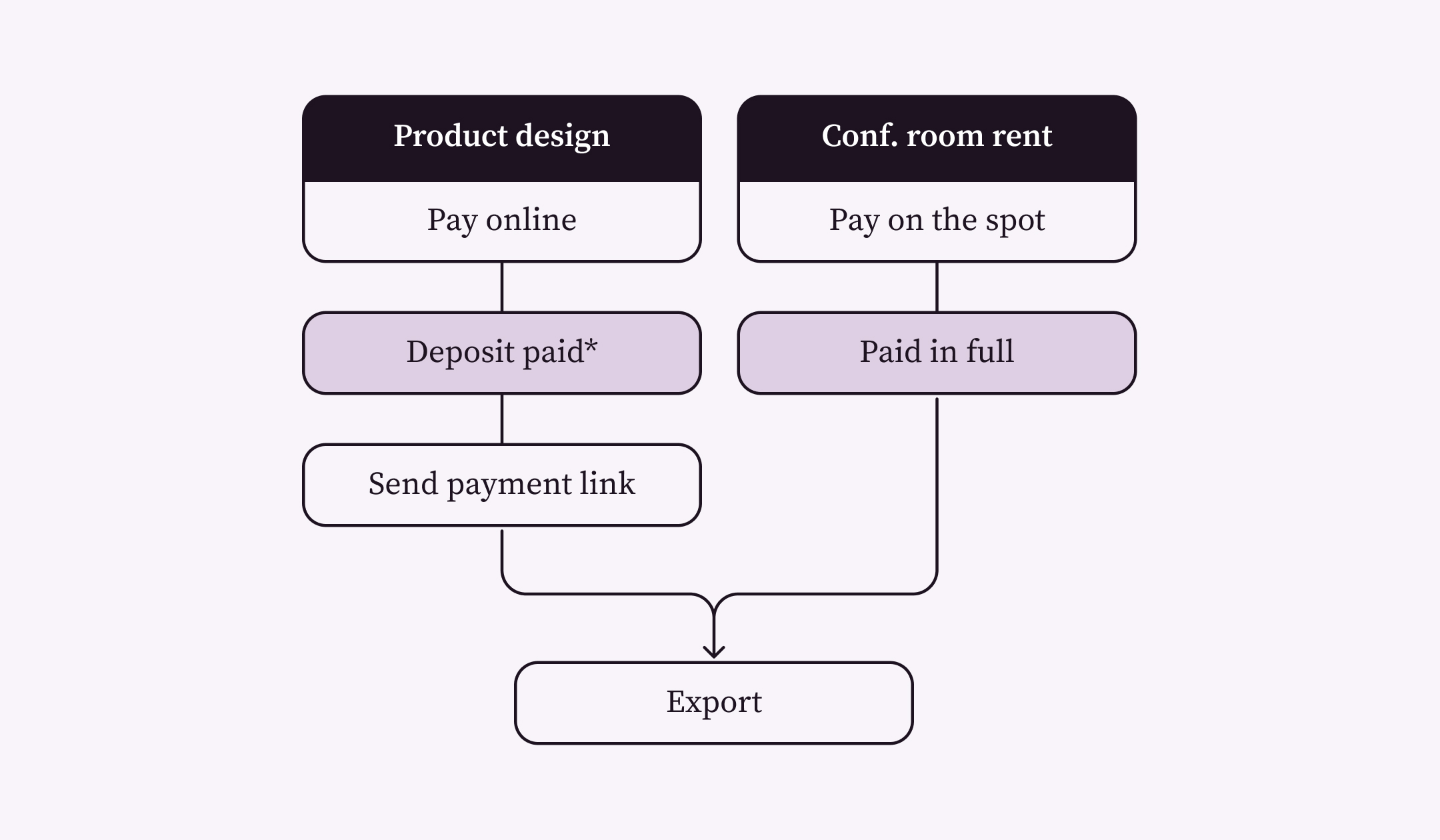

Not all services can be bought online, but all transactions should be accessible.

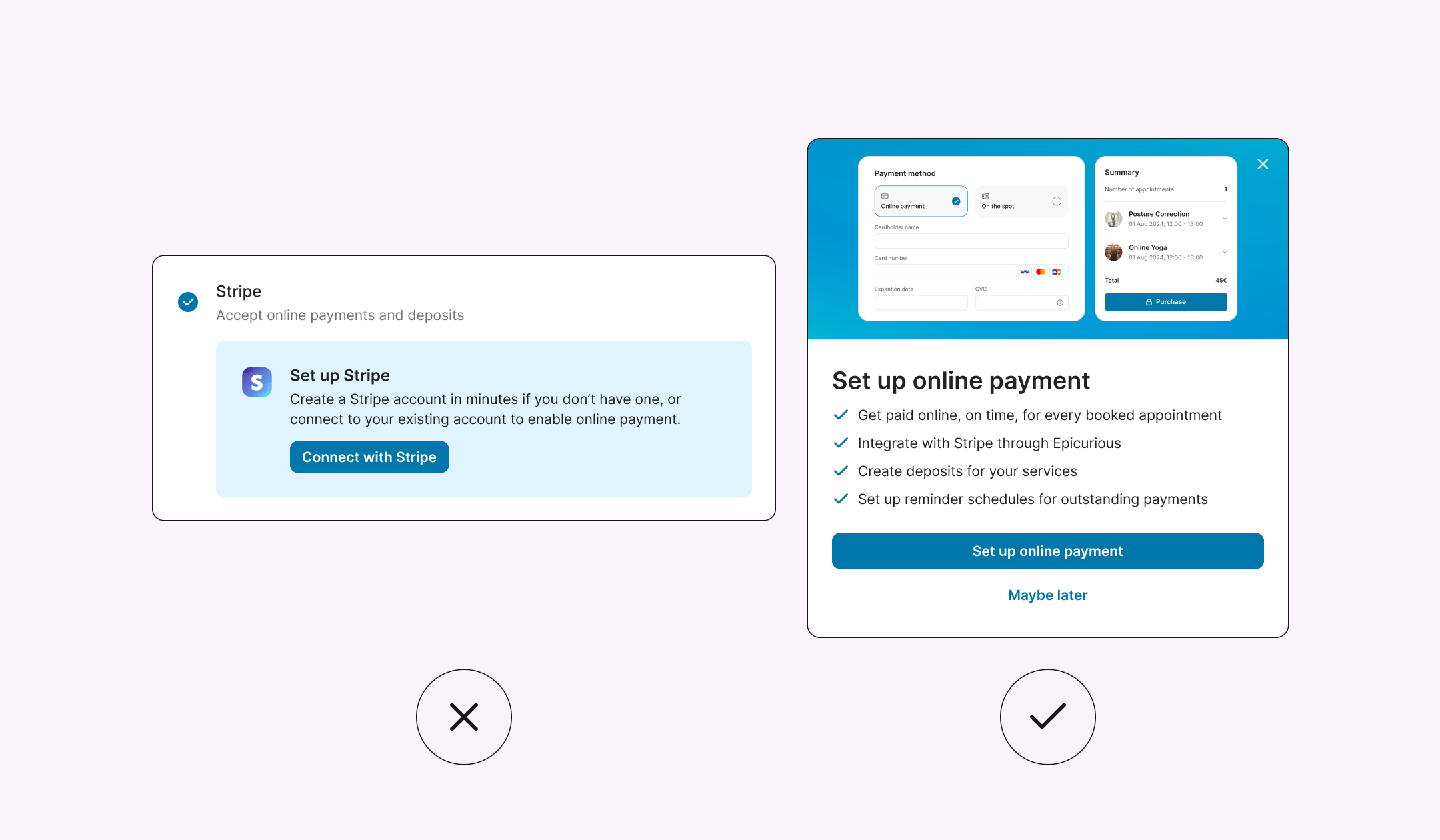

In the original designs, users struggled with finding and understanding online payment features. We tested the initial inline message vs. a new modal, with more explicit content, and the modal was chosen

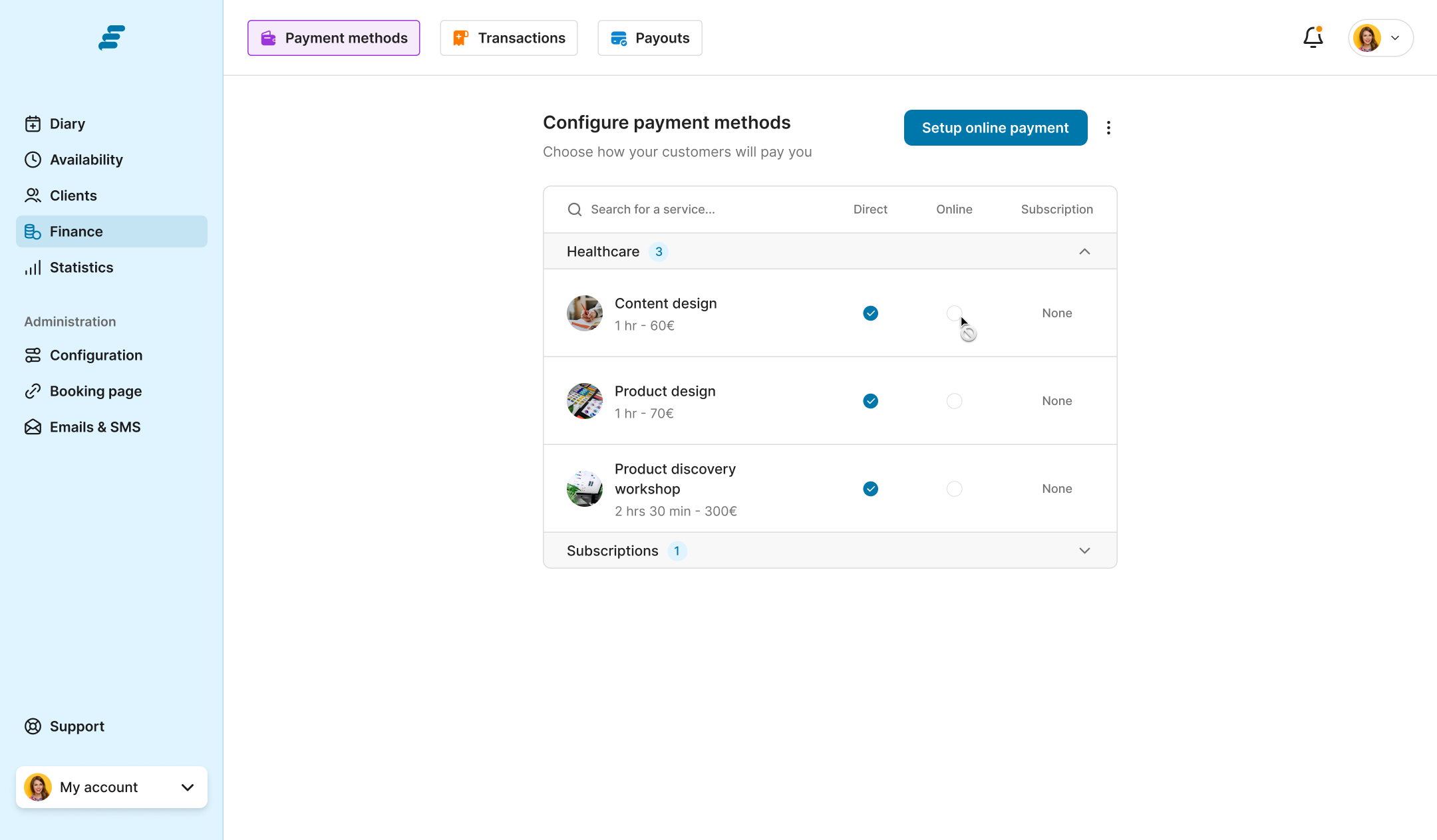

This table view (to add services to online payment) was suggested by PO to improve issues on the backend.

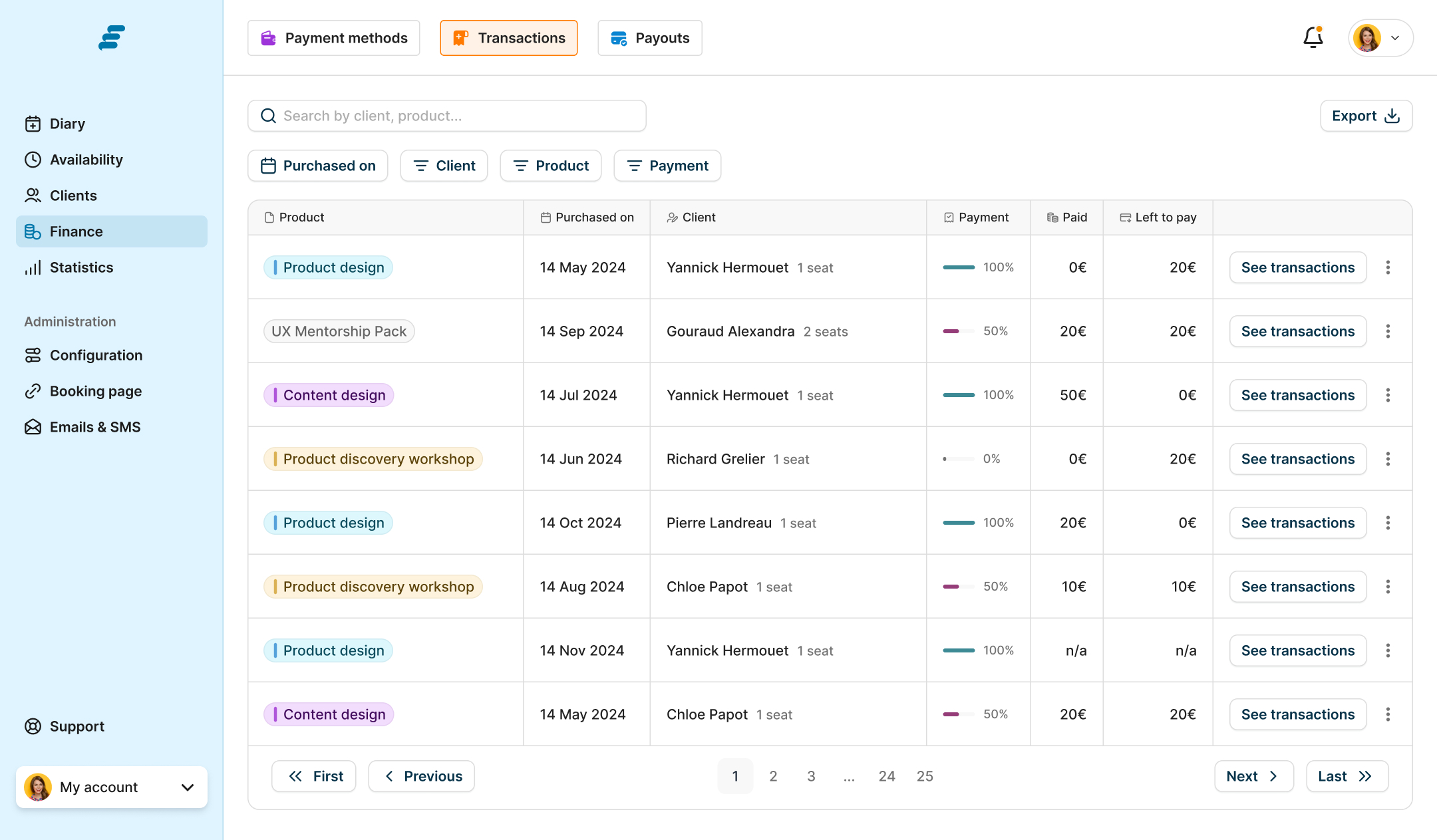

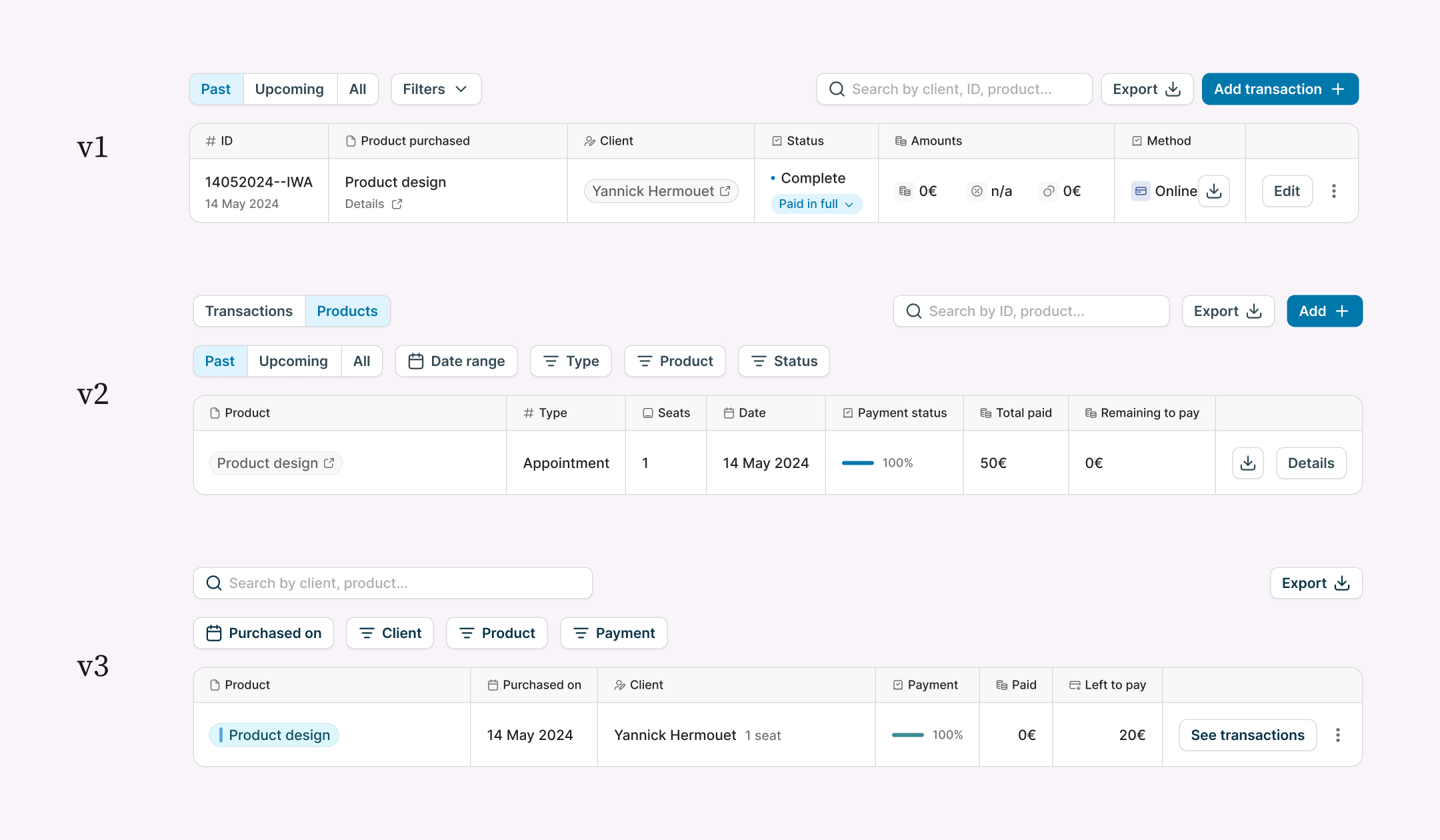

Users and stakeholders noted a difference between “transaction” entries and “purchased product” entries. I designed several iterations until settling on v3 because it worked with the existing DS patterns the best.

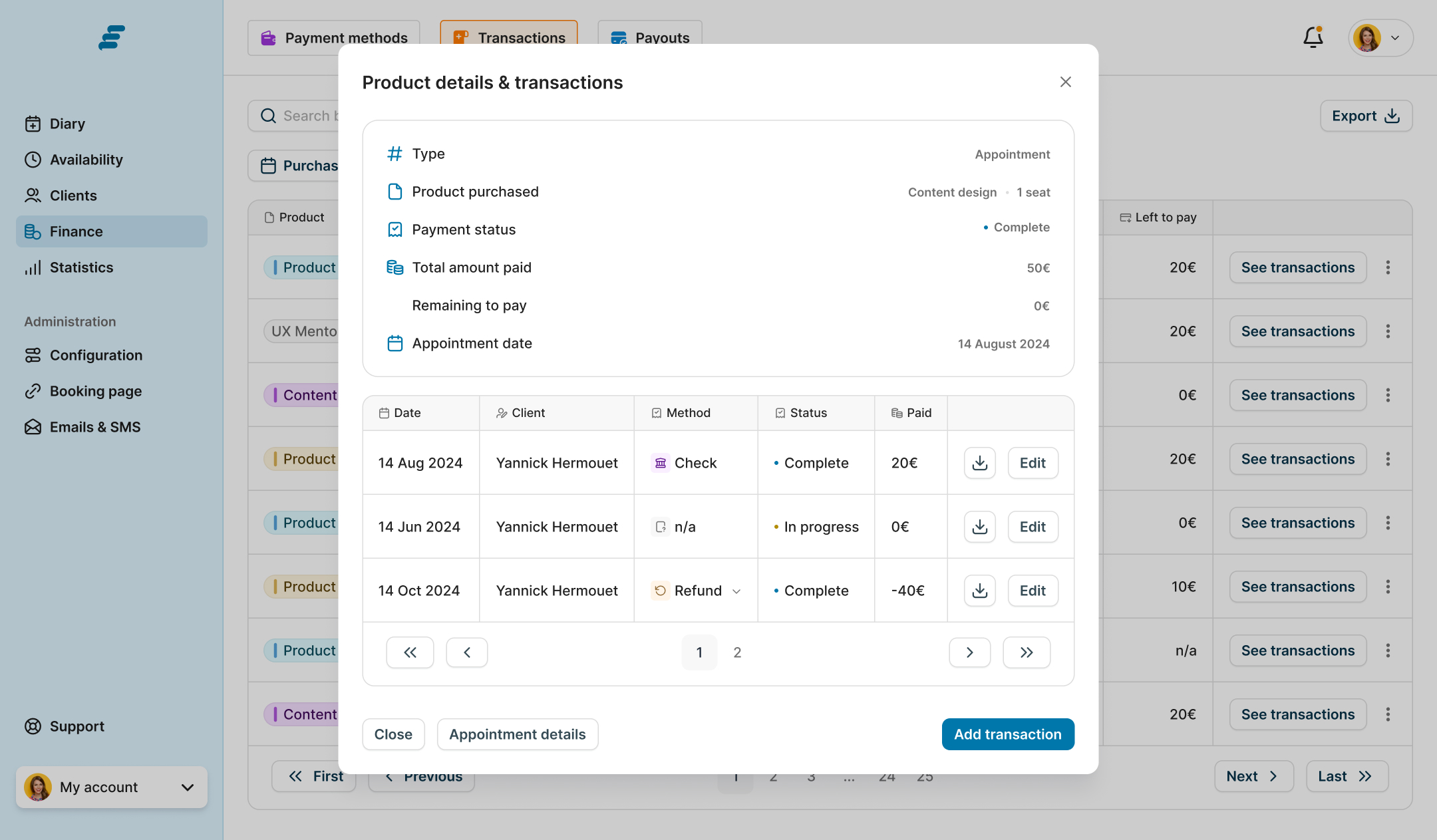

Transactions modal allows for granular overview of purchase-related transaction. One goes from product purchased to transactions.

The previous section inspired me to refine the information architecture further, applying the same progressive disclosure for the Withdrawals table, which I moved into the “Get paid” section.

☄️

Impact

Better information architecture for finance-related features led to higher activation rate on online payment configuration, and more manageable tables (to read and to export).

What's next?

Read the Not-boring PFM dashboards case study.

Email me at work@florianpopescu.com to learn more about this case study.

Book a call with me on Calendly.